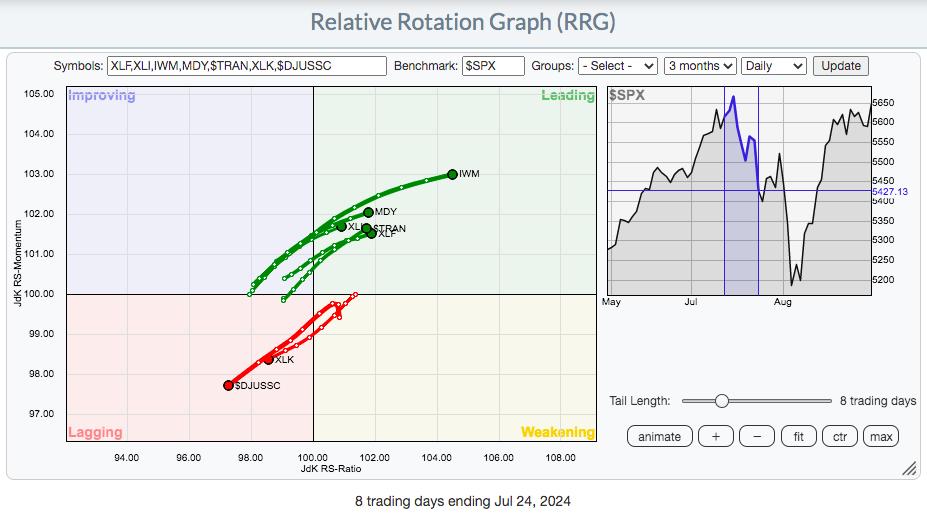

We had a sneak preview of emerging leadership on the morning of July 12th. That was the morning the June Core CPI came in well below expectations. The immediate rotation into several areas was quite evident and you can see it right here on this RRG Chart:

Financials (XLF), industrials (XLI), small caps (IWM), mid caps (MDY), and transports ($TRAN) were all poised to benefit from a change in Fed policy and the beginning of rate cuts. But Fed Chief Powell announced, and botched the announcement, in my opinion, with no rate cut and mentioning that a potential rate cut would be “on the table” for September. Now, I say “botched”, because the FOMC minutes came out two weeks later and the minutes suggested an upcoming rate cut was likely. “Likely” and “on the table” are not the same to me, but maybe others interpret it differently. Anyhow, that Fed announcement reversed the strength that we had seen in the groups mentioned earlier in July. Here’s how that RRG looked after the Fed announcement and leading up to Powell’s Jackson Hole address:

Does that not look like the exact opposite of what the market was looking at after the June CPI report was released?

Then comes the Jackson Hole speech on Friday, August 23rd, where Powell said, “it’s time for Fed policy to change”, or something to that effect. For 3 years, the Fed has been looking for proof that the decline in the annual Core CPI rate was “sustainable”. Did something happen between July 31st (Fed policy statement) and August 23rd (Jackson Hole speech) that suddenly made the Fed more comfortable of that sustainability? Was it the July CPI that showed inflation met expectations for that month? The only thing he’s proven to me, especially over the past 7 weeks or so is that the Fed changes directions more than a chameleon changes colors.

So now let’s use the RRG to track rotation once again, this time the 6 days since the Jackson Hole speech on August 23rd:

Here we go again! Now we’re beginning to see a repeat of what we saw in the middle of July as technology (XLK) and semiconductors ($DJUSSC) roll over on a relative basis, allowing the XLF, XLI, IWM, MDY, and $TRAN to lead the way.

Keep an eye on this rotation in upcoming days, weeks, and even months, because it’s exactly what I would expect to happen during a rate-cutting environment.

I look much deeper into this rotation, discussing the major indices, sectors, industry groups, and a few individual stocks in my Weekly Market Recap on YouTube, “Which Stocks Are Leading The Market”. Simply click on this link and enjoy!

Also, in my EB Digest newsletter on Monday, I’ll be featuring a now-leading stock that I believe could soar between now and year end. You can CLICK HERE to sign up for our FREE EB Digest newsletter and gain access to this stock on Monday!

Have a great long Labor Day weekend and Happy Trading!

Tom