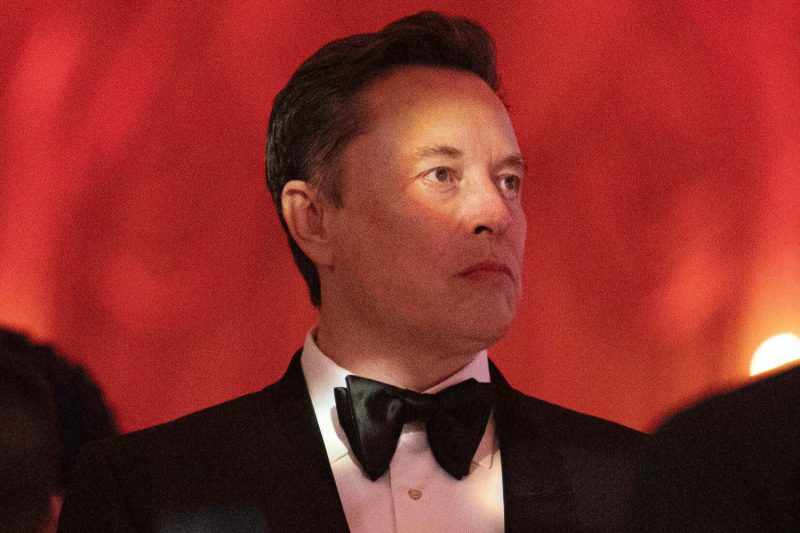

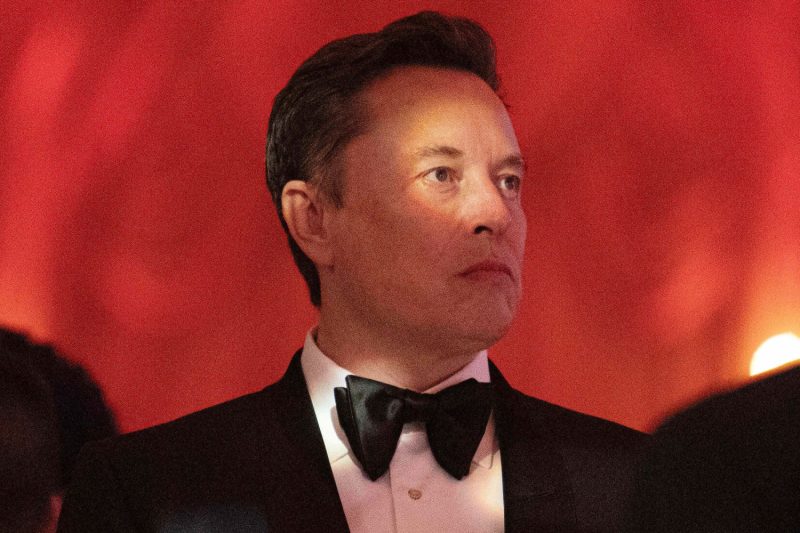

Tesla CEO Elon Musk lost his bid to get his 2018 CEO pay package reinstated on Monday when a Delaware judge upheld her prior ruling that the compensation plan was improperly granted.

The package, worth about $56 billion, was the largest compensation plan in U.S. history for a public company executive. Tesla said in a post on X, that it plans to appeal the ruling, which Musk, in a separate post on his social media site, called “absolute corruption.”

In January, Chancellor Kathaleen McCormick voided the pay plan, ruling that Musk had individually “controlled Tesla” and dictated the terms of his compensation to a board that didn’t fairly negotiate. She called the process leading to approval of that pay plan “deeply flawed.”

Following the opinion, Tesla conducted a shareholder vote in June 2024 at its annual meeting in Austin, Texas, asking investors to “ratify” Musk’s 2018 CEO pay plan. Musk’s attorneys attempted to sway the judge to reverse her opinion after the trial, leaning on the results of that vote.

McCormick wrote in her opinion on Monday that, “Even if a stockholder vote could have a ratifying effect, it could not do so here.” She added that, “Were the court to condone the practice of allowing defeated parties to create new facts for the purpose of revising judgments, lawsuits would become interminable.”

As part of Monday’s opinion, McCormick approved a $345 million attorney fee award for the lawyers who successfully sued on behalf of Tesla shareholders in order to void Musk’s pay plan.

“We are pleased with Chancellor McCormick’s ruling, which declined Tesla’s invitation to inject continued uncertainty into Court proceedings and thank the Chancellor and her staff for their extraordinary hard work in overseeing this complex case,” attorneys from Bernstein, Litowitz, Berger & Grossmann, the firm representing the plaintiff, said in a statement.

Following the January decision, Musk had lashed out at the Delaware court posting on X, “Never incorporate your company in the state of Delaware.” Tesla then held a shareholder vote to reincorporate in Texas, and officially shifted its state of incorporation there.

Musk has also moved the state of incorporation for his defense contractor company SpaceX to Texas from Delaware.

Despite the legal setback, Musk has seen his net worth jump considerably in recent weeks. Excluding all of the options wrapped up in the pay package, Musk is more than $43 billion richer since Donald Trump’s election victory last month. Tesla shares have soared 42% in the four weeks since the election on optimism that Musk’s coziness with the incoming president will lead to policies favorable to his companies.

The Tesla stock Musk still holds is worth close to $150 billion based on Monday’s closing price. That alone, not including his SpaceX stake, would put him among the world’s wealthiest people. Equilar estimates that at today’s stock price Musk’s 2018 package would have risen to be worth $101.4 billion.