For years, American financial companies have fought the Consumer Financial Protection Bureau — the chief U.S. consumer finance watchdog — in the courts and media, portraying the agency as illegitimate and as unfairly targeting industry players.

Now, with the CFPB on life support after the Trump administration issued a stop-work order and shuttered its headquarters, the agency finds itself with an unlikely ally: the same banks that reliably complained about its rules and enforcement actions under former Director Rohit Chopra.

That’s because if the Trump administration succeeds in reducing the CFPB to a shell of its former self, banks would find themselves competing directly with nonbank financial players, from big tech and fintech firms to mortgage, auto and payday lenders, that enjoy far less federal scrutiny than Federal Deposit Insurance Corp.-backed institutions.

“The CFPB is the only federal agency that supervises non-depository institutions, so that would go away,” said David Silberman, a veteran banking attorney who lectures at Yale Law School. “Payment apps like PayPal, Stripe, Cash App, those sorts of things, they would get close to a free ride at the federal level.”

The shift could wind the clock back to a pre-2008 environment, where it was largely left to state officials to prevent consumers from being ripped off by nonbank providers. The CFPB was created in the aftermath of the 2008 financial crisis that was caused by irresponsible lending.

But since then, digital players have made significant inroads by offering banking services via mobile phone apps. Fintechs led by PayPal and Chime had roughly as many new accounts last year as all large and regional banks combined, according to data from Cornerstone Advisors.

“If you’re the big banks, you certainly don’t want a world in which the non-banks have much greater degrees of freedom and much less regulatory oversight than the banks do,” Silberman said.

The CFPB and its employees are in limbo after acting Director Russell Vought took over last month, issuing a flurry of directives to the agency’s then 1,700 staffers. Working with operatives from Elon Musk’s Department of Government Efficiency, Vought quickly laid off about 200 workers, reportedly took steps to end the agency’s building lease and canceled reams of contracts required for legally mandated duties.

In internal emails released Friday, CFPB Chief Operating Officer Adam Martinez detailed plans to remove roughly 800 supervision and enforcement workers.

Senior executives at the CFPB shared plans for more layoffs that would leave the agency with just five employees, CNBC has reported. That would kneecap the agency’s ability to carry out its supervision and enforcement duties.

That appears to go beyond what even the Consumer Bankers Association, a frequent CFPB critic, would want. The CBA, which represents the country’s biggest retail banks, has sued the CFPB in the past year to scuttle rules limiting overdraft and credit card late fees. More recently, it noted the CFPB’s role in keeping a level playing field among market participants.

“We believe that new leadership understands the need for examinations for large banks to continue, given the intersections with prudential regulatory examinations,” said Lindsey Johnson, president of the CBA, in a statement provided to CNBC. “Importantly, the CFPB is the sole examiner of non-bank financial institutions.”

Vought’s plans to hobble the agency were halted by a federal judge, who is now considering the merits of a lawsuit brought by a CFPB union asking for a preliminary injunction.

A hearing where Martinez is scheduled to testify is set for Monday.

In the meantime, bank executives have gone from antagonists of the CFPB to among those concerned it will disappear.

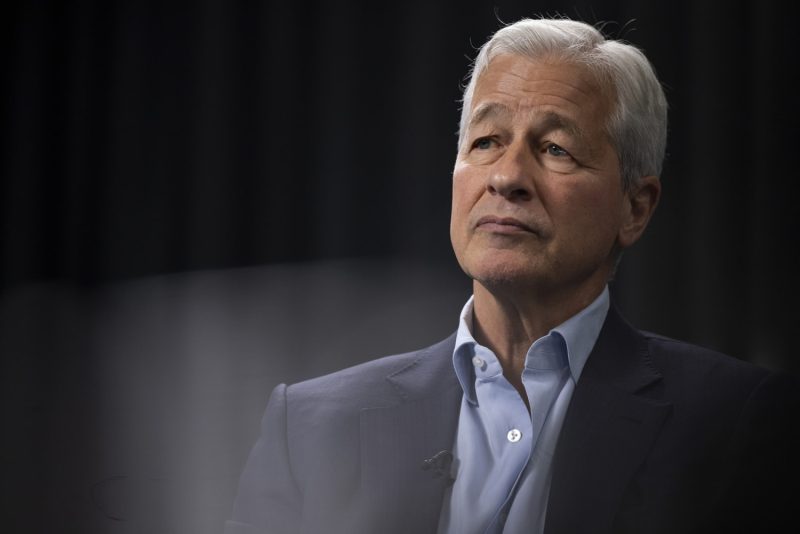

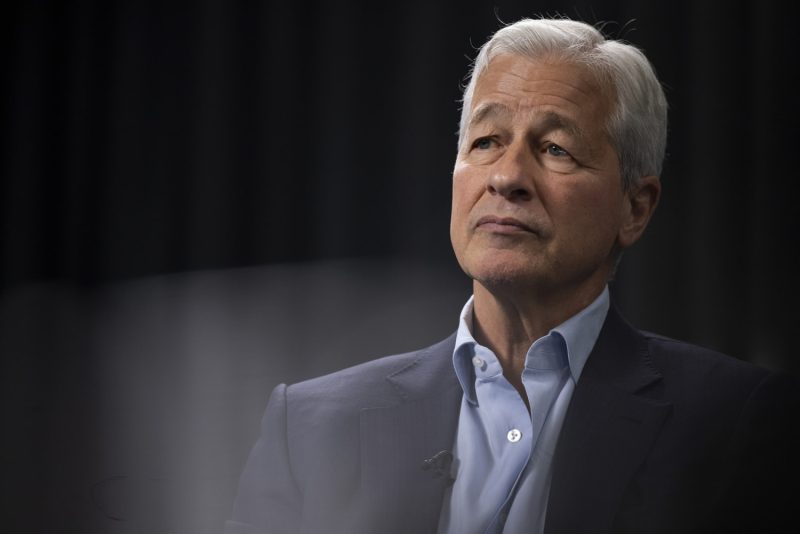

At a late October bankers convention in New York, JPMorgan Chase CEO Jamie Dimon encouraged his peers to “fight back” against regulators. A few months before that, the bank said that it could sue the CFPB over its investigation into peer-to-peer payments network Zelle.

“We are suing our regulators over and over and over because things are becoming unfair and unjust, and they are hurting companies, a lot of these rules are hurting lower-paid individuals,” Dimon said at the convention.

Now, there’s growing consensus that an initial push to “delete” the CFPB is a mistake. Besides increasing the threat posed from nonbanks, current rules from the CFPB would still be on the books, but nobody would be around to update them as the industry evolves.

Small banks and credit unions would be even more disadvantaged than their larger peers if the CFPB were to go away, industry advocates say, since they were never regulated by the agency and would face the same regulatory scrutiny as before.

“The conventional wisdom is not right that banks just want the CFPB to go away, or that banks want regulator consolidation,” said an executive at a major U.S. bank who declined to be identified speaking about the Trump administration. “They want thoughtful policies that will support economic growth and maintain safety and soundness.”

A senior CFPB lawyer who lost his position in recent weeks said that the industry’s alignment with Republicans may have backfired.

“They’re about to live in a world in which the entire non-bank financial services industry is unregulated every day, while they are overseen by the Federal Reserve, FDIC and OCC,” the lawyer said. “It’s a world where Apple, PayPal, Cash App and X run wild for four years. Good luck.”