Despite its position as a luxury automaker synonymous with prestige and performance, Ferrari N.V. (RACE) may be showing signs of a near-term downturn. Recent price action, coupled with stretched valuations and slowing shipment trends, suggests that RACE may face potential downside.

By incorporating both technical and fundamental analysis, we can see a compelling risk/reward setup for a bearish trade. The best part? This opportunity was identified automatically by the OptionsPlay Strategy Center within StockCharts.com, showcasing how you can effortlessly discover trades like this on your own.

Technical Analysis

From a technical perspective, the chart reveals a concerning pattern:

- Broken Support: After breaking below $460 support in early November, RACE has rallied back to retest this level as resistance, providing a favorable risk/reward for bearish exposure.

- Underperformance: Its underperformance relative to the S&P 500 with negative momentum further reinforces the case for downside toward the $400 support level.

FIGURE 1. DAILY CHART OF FERRARI NV. The stock has broken support and is underperforming relative to the S&P 500. Chart source: StockCharts.com. For educational purposes.

FIGURE 1. DAILY CHART OF FERRARI NV. The stock has broken support and is underperforming relative to the S&P 500. Chart source: StockCharts.com. For educational purposes.

Fundamental Analysis

RACE’s valuation appears lofty, given its modest growth profile:

- High Valuation, Moderate Growth: Trading at 47x forward earnings, RACE commands a substantial 490% premium to the industry. Yet expected revenue growth of only 9% and EPS growth of 12% offer limited justification for such a rich multiple.

- Margins and Premium Pricing: To its credit, Ferrari boasts a best-in-class net margin of 22%; however, even premium margins fall short of supporting the current multiple without correspondingly robust growth.

Recent quarterly results highlight the concerning picture. Although Q3 2024 saw net revenues increase by 6.5, shipments declined by 76 units year-over-year, with notable weaknesses in key regions like China, Hong Kong, and Taiwan. Rising SG&A expenses—driven by digital initiatives and brand investments—also weigh on near-term profitability. While Ferrari’s emphasis on hybrids and personalization points toward innovation and resilience, the current fundamentals do not convincingly justify its elevated valuation.

Options Strategy

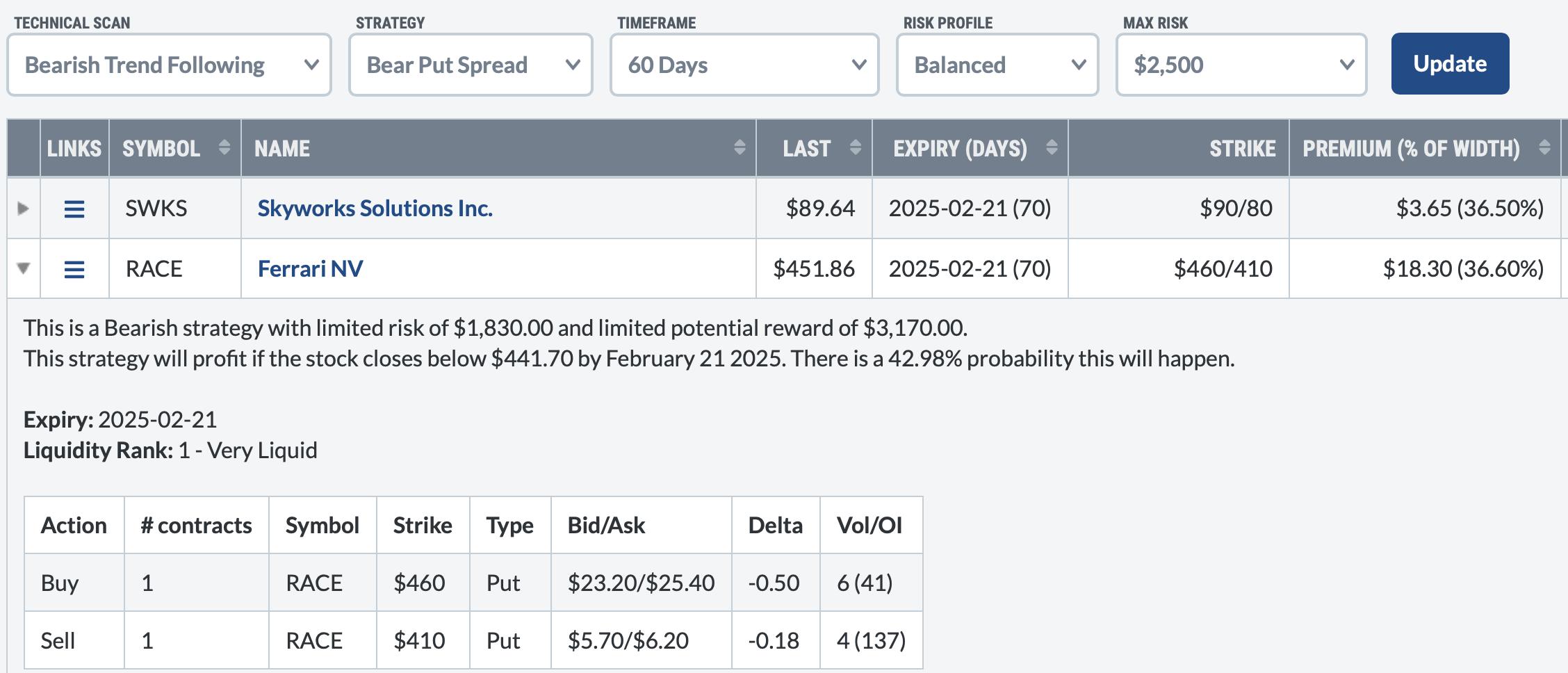

Given the bearish timing and valuation concerns, a put vertical spread offers a defined-risk way to position for potential downside. The OptionsPlay Strategy Center suggests buying the February $460/$410 Put Vertical at a $18.30 debit:

- Buy: February $460 Put @ $24.30

- Sell: February $410 Put @ $6.00

- Net Debit: $18.30 per share or $1,830 total per contract

FIGURE 2. BUYING A PUT VERTICAL SPREAD IN FERRARI NV. Here you see the strategy details of buying a Feb. 21, 2025 $460/$410 put vertical.Image source: OptionsPlay Strategy Center in StockCharts.com. For educational purposes.

FIGURE 2. BUYING A PUT VERTICAL SPREAD IN FERRARI NV. Here you see the strategy details of buying a Feb. 21, 2025 $460/$410 put vertical.Image source: OptionsPlay Strategy Center in StockCharts.com. For educational purposes.

This strategy:

- Maximum Potential Risk: $1,830

- Maximum Potential Reward: $3,165

- Breakeven Point: $441.65

- Probability of Profit: ~43%

If RACE remains under pressure and trades below $441.65 by February 21, 2025, this strategy stands to benefit, offering an attractive risk-to-reward profile for bearish traders.

Unlock Real-Time Trade Ideas with OptionsPlay Strategy Center

This bearish opportunity on RACE emerged within seconds, courtesy of the OptionsPlay Strategy Center on StockCharts.com. By employing its Bearish Trend Following scan, the platform identified RACE as a candidate, then structured an optimal options trade to match the bearish thesis—no lengthy research required.

FIGURE 3. FERRARI NV WAS A CANDIDATE UNDER THE BEARISH TREND FOLLOWING SCAN.

FIGURE 3. FERRARI NV WAS A CANDIDATE UNDER THE BEARISH TREND FOLLOWING SCAN.

Image source: OptionsPlay Strategy Center in StockCharts.com.

By subscribing to the OptionsPlay Strategy Center, you can:

- Effortlessly Discover Trading Opportunities: Market scans highlight potential trades in real-time, tailored to your market outlook.

- Receive Optimal Trade Structures: Access pre-calculated options strategies that align with your view, risk tolerance, and profit targets.

- Save Time and Enhance Efficiency: Eliminate hours of research—find the best options trades within seconds, every day.

Don’t let valuable trading opportunities slip away. Subscribe to the OptionsPlay Strategy Center today and empower your trading journey with the tools and insights you need to stay ahead of the market.