Despite attempts to break higher, Tractor Supply Co. (TSCO) may be setting up for a potential move lower. Recent price action and valuation concerns suggest that TSCO’s upside might be limited in the near term.

Despite attempts to break higher, Tractor Supply Co. (TSCO) may be setting up for a potential move lower. Recent price action and valuation concerns suggest that TSCO’s upside might be limited in the near term.

In this analysis, we’ll outline the technical signs of weakness, delve into the fundamentals that appear stretched, and review a limited-risk options strategy to capitalize on a bearish outlook. All of this was identified instantly using the OptionsPlay Strategy Center within StockCharts.com, demonstrating how subscribers can uncover similar opportunities instantly.

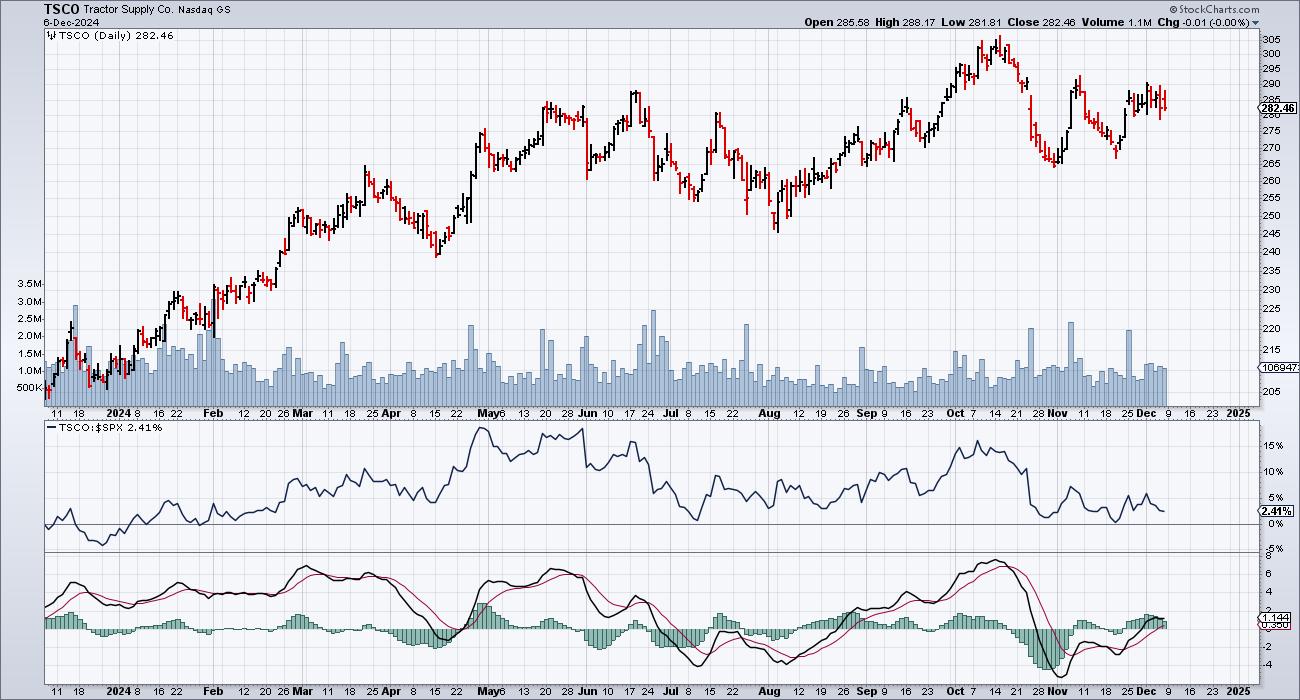

From a technical standpoint, TSCO has shown troubling signs:

- Failed Breakout. After initially breaking out above the $290 resistance area in October, TSCO has failed to maintain any meaningful follow-through. Instead, it has slid back into its prior trading range between $265 and $290.

- Underperformance and Negative Momentum. This inability to hold higher ground has coincided with relative underperformance versus the S&P 500. As the stock struggles to sustain gains, negative price momentum suggests increasing downside risks.

FIGURE 1. DAILY CHART OF TRACTOR SUPPLY CO. The stock is retreating toward its previous trading range between $265 and $290. Tractor Supply is also underperforming the S&P 500, and the MACD indicates momentum is slowing down.Chart source: StockCharts.com. For educational purposes.

Beyond the chart, TSCO’s fundamentals raise questions about its valuation:

- Modest Growth, High Valuation. With an expected EPS growth of just 7% and revenue growth of 4%, TSCO’s top and bottom line expansion trails its industry peers. Yet the stock trades at a hefty 25x forward earnings multiple.

- Slim Margins and Rising Debt. A net margin of only 7% offers limited cushion to navigate headwinds, especially as the company’s debt load increases each quarter. Paying a premium multiple for modest growth, narrow margins, and escalating leverage challenges the justification for TSCO’s current valuation.

Recent earnings announcements provide mixed signals. On the positive side, Q3 2024 net sales rose by 1.6%, and gross margin improved by 56 basis points, reflecting some operational efficiencies. The company also reported EPS in line with expectations and pursued strategic acquisitions like Allivet to bolster its pet product segment. However, TSCO faced a slight decline in comparable store sales, a 5.3% decrease in net income, and missed analyst sales estimates. Sluggish discretionary spending and higher expenses have also weighed on performance. Looking forward, TSCO must navigate a delicate balance between growing sales and managing costs—an increasingly challenging task if consumer spending remains tepid.

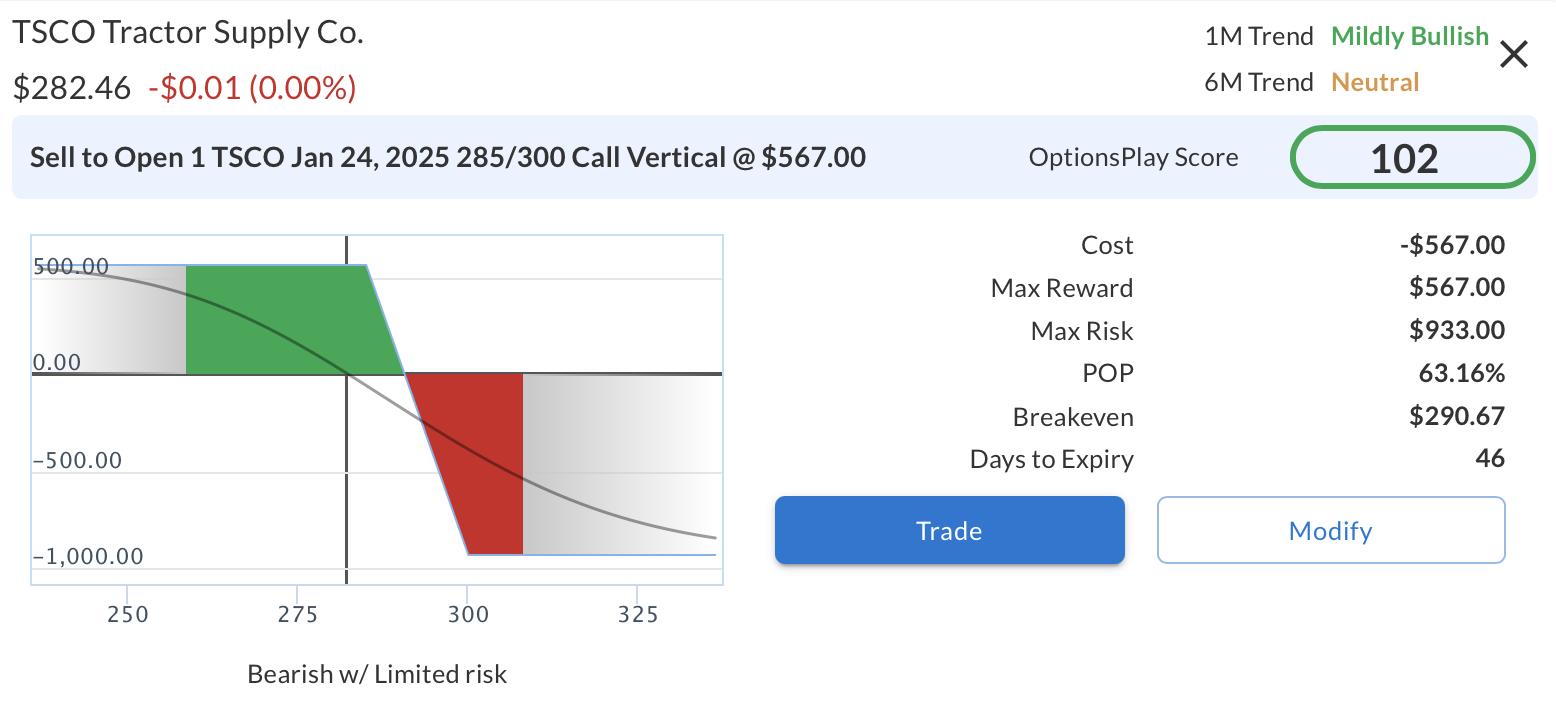

Options Strategy: Call Vertical Spread

To position for a potential downside, the OptionsPlay Strategy Center suggests selling a Jan 24, 2025 $285/$300 Call Vertical @ $5.70 Credit. This entails:

- Selling January 24, 2025, $285 Call at $9.70

- Buying January 24, 2025, $300 Call at $4.03

- Net Credit: $5.70 per share (or $570 per contract)

- Maximum Potential Reward: $567

- Maximum Potential Risk: $933

- Breakeven Point: $290.70

- Probability of Profit: 63%

This neutral-to-bearish strategy generates premium income upfront and profits if TSCO remains below $290.70 at expiration (see strategy details below).

FIGURE 2. SELLING A CALL VERTICAL SPREAD IN TRACTOR SUPPLY CO. Here you see the strategy details of selling a Jan 24, 2025 $285/$300 call vertical.Image source: OptionsPlay Strategy Center in StockCharts.com. For educational purposes.

Unlock Real-Time Trade Ideas with OptionsPlay Strategy Center

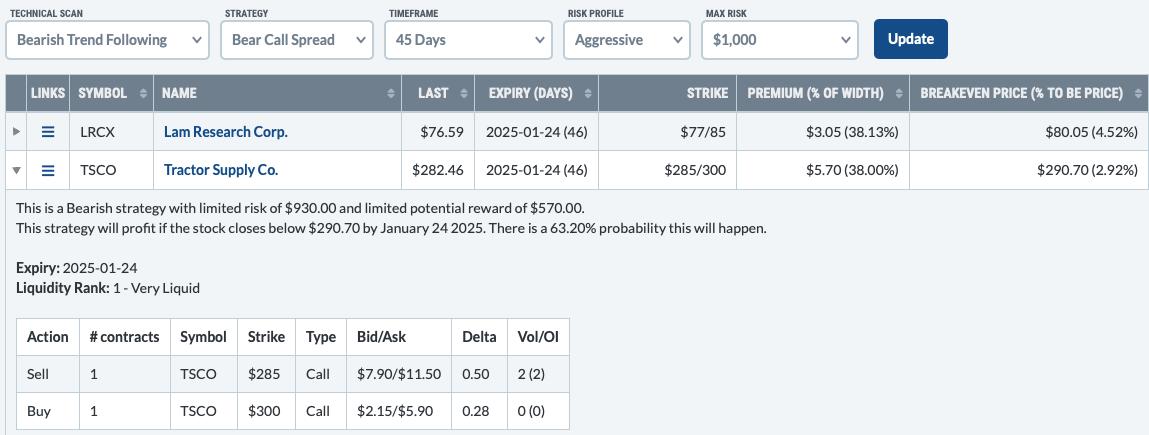

The bearish opportunity in TSCO was identified swiftly using the OptionsPlay Strategy Center, which is now available at StockCharts.com. The platform’s Bearish Trend Following scan zeroed in on TSCO as a candidate for downside exposure and even structured the optimal options trade in real-time.

By subscribing to the OptionsPlay Strategy Center, you gain access to:

- Automated Market Scanning. Instantly discover trade opportunities aligned with various market outlooks and strategies.

- Optimal Trade Structuring. Receive tailor-made options strategies that consider both your conviction and risk tolerance.

- Time-Saving Insights. Access actionable ideas within seconds, eliminating hours of manual research and enabling more informed decision-making.

FIGURE 3. TRACTOR SUPPLY CO. WAS A CANDIDATE UNDER THE BEARISH TREND FOLLOWING SCAN.Image source: OptionsPlay Strategy Center in StockCharts.com.

Don’t miss out on valuable trading opportunities. Subscribe to the OptionsPlay Strategy Center today and streamline your trading approach. With tools designed to keep you ahead of the market, you can consistently find the best options trades and harness them efficiently every day.