Following the recent market fluctuations, with a sharp decline and a subsequent rally, it’s crucial to examine these movements’ underlying factors.

Utilizing relative rotation graphs (RRGs), we can gain insights into the current trends between growth and value stocks and their performance across different size segments.

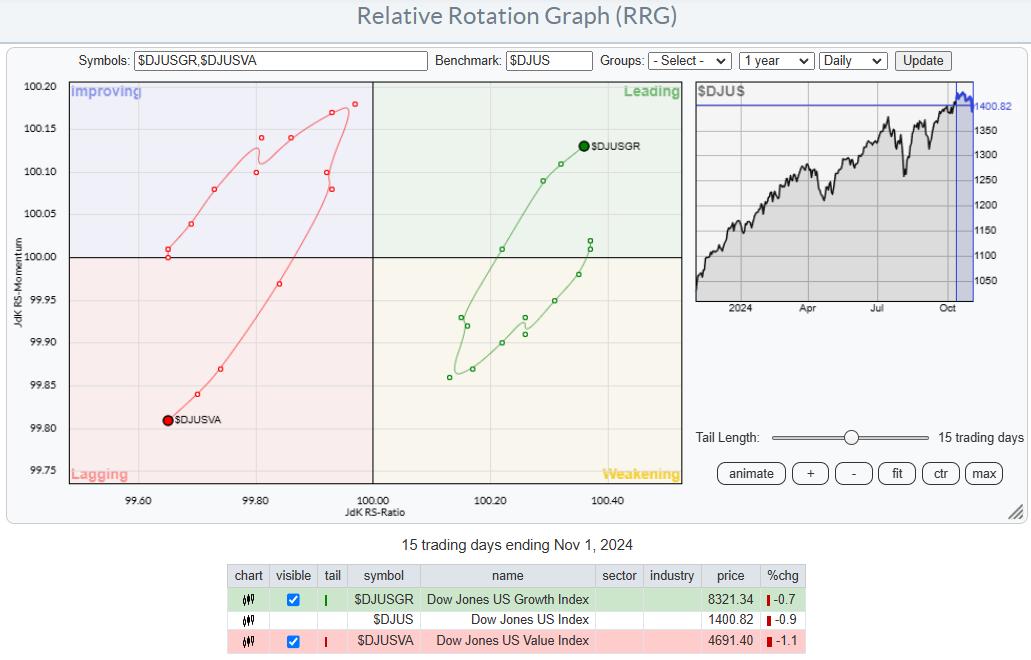

Growth vs Value on Daily RRG

The daily RRG clearly prefers growth stocks over value stocks. The Dow Jones US Growth Index is advancing into the leading quadrant, indicating strong momentum, while the Dow Jones US Value Index is retreating into the lagging quadrant.

This rotation shows the recent shift towards growth stocks.

Large Cap Leads the Way

When we dissect the market by size rather than growth or value, we observe that large-cap stocks are positioned within the leading quadrant, albeit with a moderate trajectory.

Conversely, mid-and small-cap stocks are lagging, with mid-caps experiencing the most unfavorable rotation. This pattern indicates that large-cap stocks are currently outperforming their smaller counterparts.

A Closer Look at Growth and Value Across Sizes

The third RRG offers a detailed view of growth and value stocks by size.

Here, large-cap growth stocks stand out as they ascend within the leading quadrant. Mid-cap growth stocks show signs of recovery in the weakening quadrant, and small-cap growth stocks are gaining momentum in the lagging quadrant.

However, all value stocks, regardless of size, are declining, with large-cap value stocks also moving toward the lagging quadrant.

This separation underscores the near-term dominance of large-cap growth stocks.

The Influence of Large Cap Growth Stocks

Using the New York FANG index as a proxy for large-cap growth stocks further illustrates where the market’s strength lies.

A cluster of these stocks, including Tesla, Google, Amazon, and Netflix, are positioned in the leading quadrant, with Tesla exhibiting particularly high momentum. Microsoft is on the cusp of joining the leading quadrant, while Meta rebounds from the lagging quadrant.

Apple and NVIDIA, despite weaker tails, remain strong in relative strength, and AMD and Snowflake are also noteworthy, though they are currently lagging.

This concentration of a few stocks driving the market suggests a narrow foundation, which is a recurring theme for the US stock market.

Examining the charts of four significant market influencers—Apple, Tesla, Nvidia, and AMD—reveals potential risks.

NVDA

After surpassing its June high, NVIDIA is now struggling to advance, as indicated by a negative divergence in the RSI and price.

A break below the support level of 130 could trigger further declines.

AMD

AMD’s chart shows a series of lower highs and lower lows, with a potential break in raw relative strength on the horizon.

If the price downtrend continues, it will very likely trigger the start of a new down leg in an already established relative downtrend.

TSLA

Tesla’s inability to overcome resistance between 270 and 275, coupled with a negative RSI divergence, suggests limited upside potential.

AAPL

Apple, which peaked in mid-July, has since experienced a downward trend.

A break below the crucial support level around 213 could lead to further losses and trigger a continued weakness in its relative strength.

Conclusion: The Market’s Narrow Foundation

The market is back at a narrow foundation as we have seen it before.

The risk remains high, especially if these four stocks fail to advance and begin to decline, and when the observed divergences come into play.

Such a scenario would undoubtedly challenge the S&P 500’s ability to climb higher.

#StayAlert and have a great weekend, –Julius